By Susan Denzio, captive coordinator, MAPP

The healthcare landscape presents many challenges for business owners and, with the turn of a new year, it is likely to become even more difficult. The very purpose of insurance, a mechanism to protect against unforeseen costs, is needed to protect the human capital asset – employees and dependents – from the risk associated with medical conditions. However, for most business owners, navigating through the complexities of healthcare – rising costs, plan structures, evolving trends – is essential to protect the well-being of the workforce and to maintain the company’s competitiveness.

For decades, healthcare has been a benefit of employment from both the employer’s and the employee’s perspective. However, because of the increasing costs, many employers are reassessing the role of being the provider and subsidizer of healthcare benefits. While many employers continue to sponsor healthcare plans, there has been a shift to integrate the value-based care philosophy and motivate employees to shoulder more responsibility – not only for maintaining and improving health outcomes but also for the associated costs by increasing the employee’s financial contributions.

With the diversity of the workforce spanning different age groups, job roles and health needs, understanding the design and administration of effective insurance plans can be extremely challenging. In addition, the most arduous task can be striking the right balance between comprehensive coverage and the affordability of that coverage.

Balancing the Risk vs. the Cost

One of the foremost challenges for business owners is dealing with the relentless rise in healthcare costs. Ask any business leader and healthcare costs likely will be mentioned as the largest employee-related expense. Whether it’s due to advancements in medical technology, increased demand for healthcare services or the inflationary nature of the industry, company executives continue to find themselves grappling to discover solutions to offset escalating expenses.

Understanding risk tolerance is another hurdle for companies offering a healthcare plan. Employers must adopt proactive risk management and cost containment strategies to mitigate the company’s exposure. By reviewing the potential threats and the resources needed to minimize them, an organization can assess what it is willing to tolerate and develop strategies to match.

Funding Methodologies

There are two primary methodologies for funding health insurance and managing the risk or the potential exposure to a company. The first often is achieved by being a part of a large [risk] pool with little control or transparency (fully insured plans). The second is more of a stand alone program that offers greater control and transparency, along with an increased level of risk (partially self-funded plans).

Fully insured plans protect against loss by capping the company’s overall financial liability; however, this method limits data transparency, the ability to pinpoint root causes of cost escalation and the development of actions to remedy them.

Additionally, the fully insured model requires plan owners to prepay for bills that might occur, not for what actually occurred. For this reason, the fully insured methodology can more accurately be categorized as risk avoidance vs. risk management.

To actively engage in managing risk and obtain the benefits of controlling costs, an employer must participate in what is commonly referred to as a partially self-funded program. In this model, the employer covers the costs of medical expenses up to a specific financial limit for each individual also while limiting the financial liability for the sum of all medical expenditures via third-party insurance.

Under the self-insured platform, employers gain access to detailed data about medical claims and are given greater choices in determining the service providers and structure of their health benefits plan. These selections are predicated on the overarching goals and objectives of the employer’s risk management strategy.

There is a strategy (see sidebar) that offers the best of both worlds – the strength of aggregation with the control and transparency of individual plans – where the approach is to provide accessible coverage when things go bad.

Trending Strategies

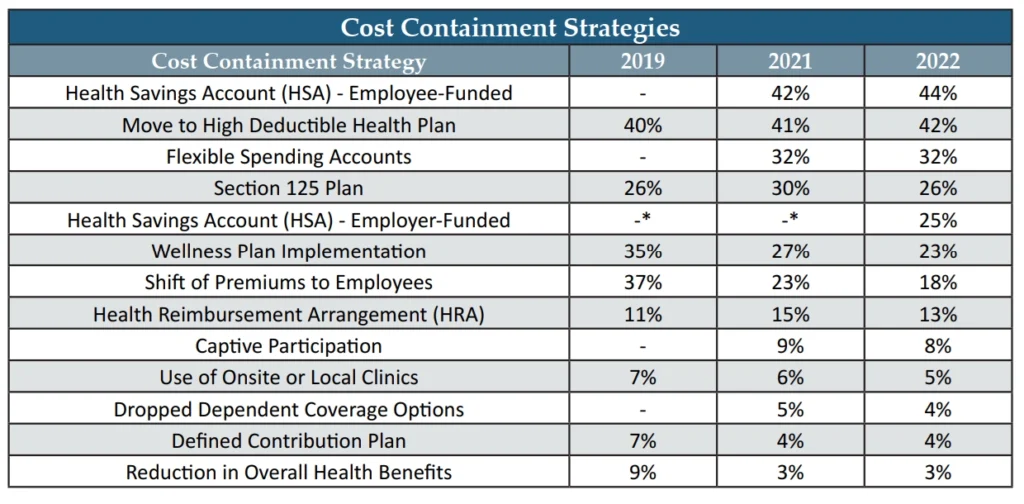

Amidst the obstacles manufacturers encounter through the healthcare maze, there are attainable solutions that can help companies strike a balance between cost and risk. The 2022 Health and Benefits Report, compiled by the American Mold Builders Association (AMBA), the Manufacturers Association for Plastics Processors (MAPP) and the Association for Rubber Products Manufacturers (ARPM), outlines a list of the unique cost-containment strategies that have been implemented by manufacturers to combat the escalating costs associated with providing healthcare benefits. Note that in 2022, employer-funded HSA contributions evolved as a new approach for some companies (Chart 1).

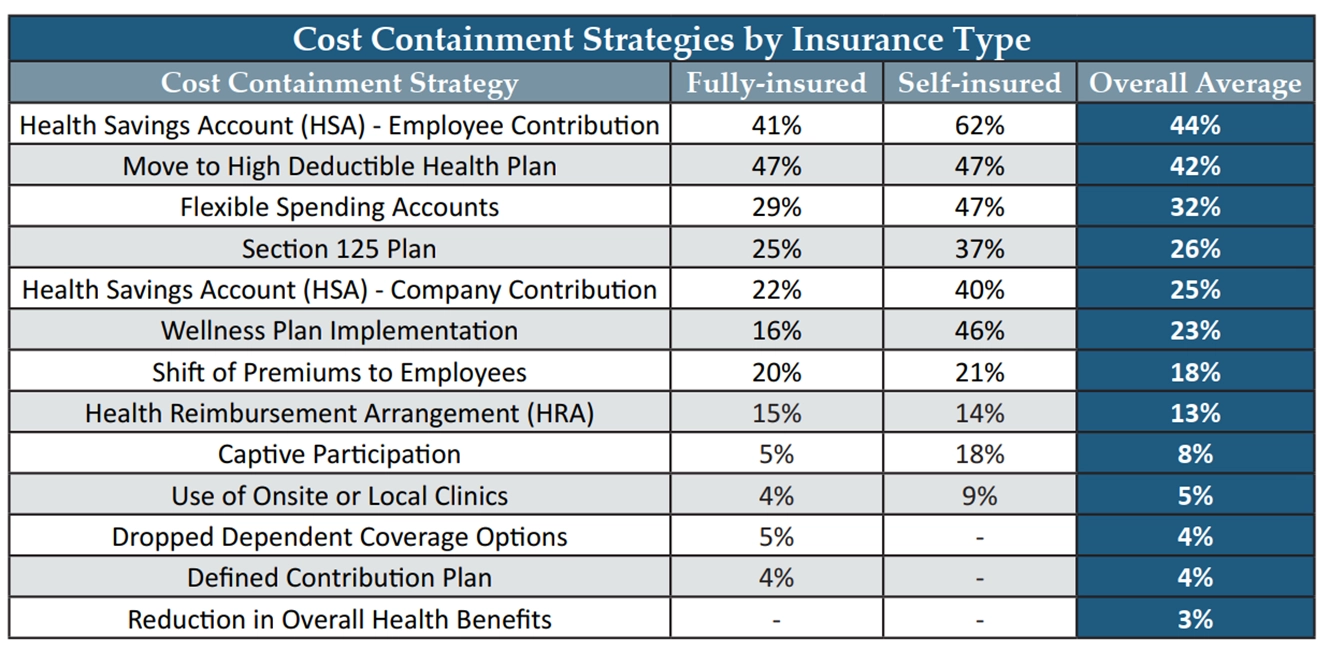

As was previously noted, self-funding offers greater control and transparency. This allows employers to gain access to detailed data about submitted claims and the ability to make greater choices when selecting the service providers and developing the structure of their health benefits plan. This is evident in the data shown, as a higher percentage of self-insured manufacturers were able to utilize cost-containment strategies compared to those under a fully insured platform (Chart 2).

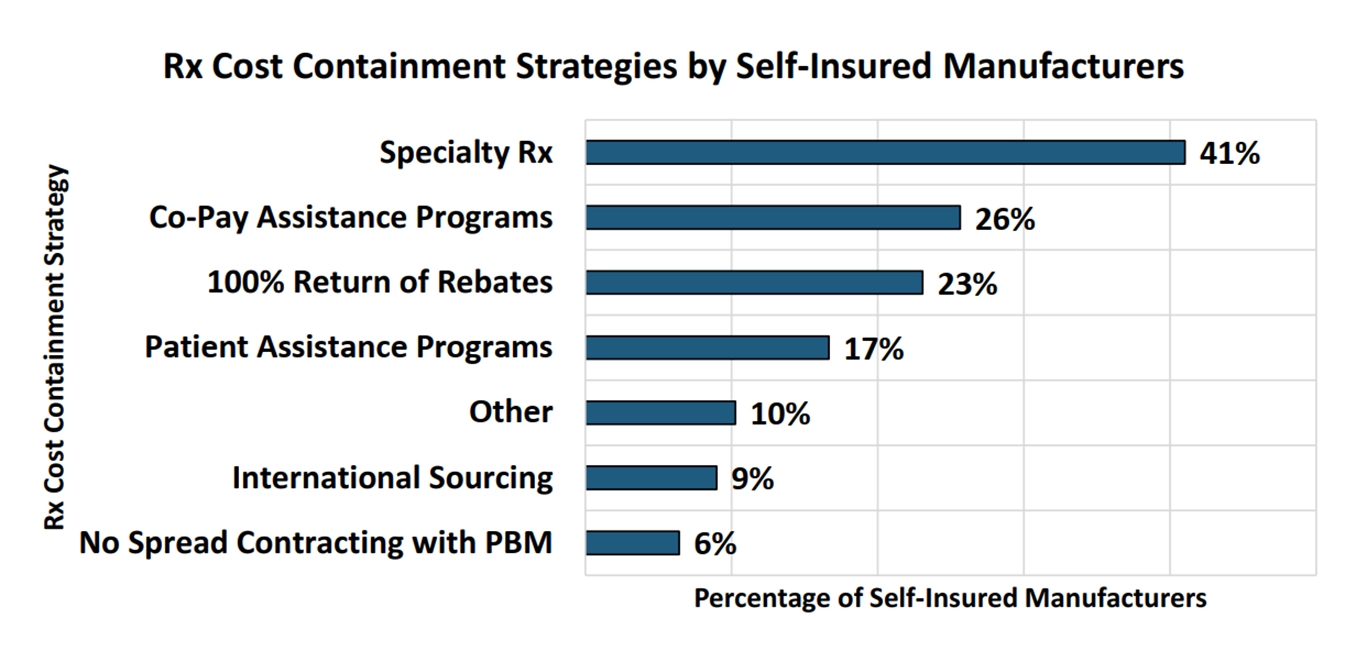

Furthermore, while most healthcare plans include prescription drug benefits, fully insured plans are not privy to cost-containment opportunities because the health insurance carrier controls the contracting arrangements and accepts the entire liability of the health plan, which typically includes prescriptions. Respondents utilizing a self-funded platform cited a few strategies specific to minimizing drug costs for both the employee and the health plan (Chart 3).

The cost savings realized by manufacturers employing any of these tactics are shocking. Specifically noted by a participating employer, between the company and the employees, more than $250,000 was saved – just on drugs – enough to provide local near-site clinic access to its employees at no cost!

The 2024 Health and Benefits Survey launched on February 12, 2024, giving manufacturers the opportunity to submit data that will be compiled anonymously and shared in the 2024 Health and Benefits Report later this year.

![]()

We’ve Slayed the Healthcare Dragon… and We’re Winning!

The paradigm is shifting as CAPTIV8 is changing the way insurance premium dollars can better serve its members by leveraging the fully insured methodology of pooling with the control and transparency of a self-insured model. This program utilizes a unique contracting approach by putting employer premiums to work for its members, specifically during bad times. The CAPTIV8 program facilitates multiple partially self-funded employers aggregating a majority of the premium for one sole purpose – to be utilized by its members. In the event it is utilized for claims because it is a member premium supporting other members’ needs, the insurance entity (the captive) does not need to recoup the premium as aggressively at renewal. In fact, given the captive premium is going to be returned to the members through either expense reimbursements or profit distributions, there is no need to charge for its use. Instead, the increase associated with the utilization of these premium dollars is directly linked to the forward-looking projection of risk for the individual or group of individuals who generated the claims – not a penalty for using the premium. By sharing the premium, members are insulated from market factors and the pricing of commercial insurance.

More information: sdenzio@firstresourceinc.com