by Todd Parsapour, investment banking managing director, Stout

The global pandemic has dramatically affected people, governments and businesses during the past year. Many companies have had to navigate a very dynamic and volatile environment, which has included employee and customer health concerns, rapid changes in product and service demand, and supply chain disruptions, among other items. Businesses that were contemplating merger and acquisition (M&A) processes have had to carefully reassess the environment since the pandemic. Stout saw an initial pause in sell-side processes at the onset of COVID-19. However, launch activity has rebounded recently to pre-COVID levels and appears robust in 2021. We consider the following items among the most important in helping clients decide whether to move forward or delay launches:

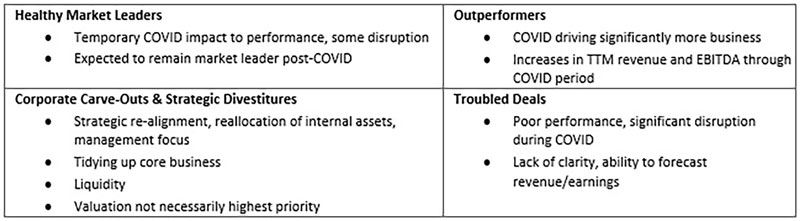

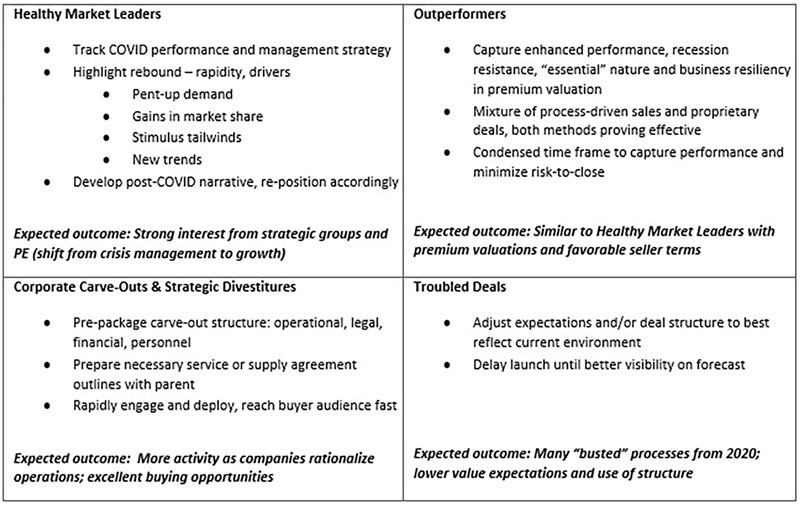

- The business and recent financial results have not been materially affected by pandemic issues. While there is no exact metric to use (e.g., percentage change in revenue or earnings before interest, taxes, depreciation and amortization [EBITDA]), financial performance that has remained in line with pre-pandemic performance or exhibited growth is a good benchmark. Figure 1 illustrates four general categories in which we define businesses. The Healthy Market Leaders and Outperformers would best meet this standard, though lower valuation standards or necessity could drive the other two categories.

- Run-rate financial results have trended back to pre-pandemic levels, demonstrated through several months of consistent recovery. Three to six months of performance typically is enough to illustrate a trend.

- Backlog or project work portends substantial recovery in future months or provides greater visibility.

- Positive financing availability for the business or industry sector. A willingness of lenders to provide financing to the business or sector is paramount.

If one or more of these factors are met, an active M&A market has been found. After witnessing a pause in activity during the late first quarter and the second quarter of 2020, financial investors/private equity (PE) and strategics resumed M&A activity (Figure 2). There is substantial capital available to the investors. Debt financing has also largely recovered from second-quarter levels, though certain industries have seen continued weakness (e.g., energy, retail, and travel and hospitality), and asset-based lending represented a meaningful portion of activity immediately after the first wave of the pandemic (versus cash flow-based lending).

The marketing stage

The initiation of transactions has encountered more modest changes (Figure 3). Most clients can accommodate limited in-person due diligence sessions prior to creating marketing materials, and fortunately, much of the due diligence process can be addressed remotely. The more creative element centers around how to position the business – how has COVID affected, benefited, altered the underlying business.

The marketing process itself has experienced relatively little change as this typically is managed via phone and email. Minimal changes were observed to firm responsiveness during the pandemic. One of the more challenging M&A process steps has centered around management presentations and site visits, subsequent to receiving initial indications of interest. A number of PE groups and strategics have restricted employee travel unless absolutely necessary. In order to address these buyers’ health concerns and move forward, a hybrid approach has been adopted to enable the important introductions and discussions between buyers to sellers. This approach has included:

- Conducting socially distanced (and masked) management presentations to small groups of buyer representatives willing to travel to meetings

- Conducting virtual Zoom management presentations for larger groups unable to travel

- Offering site visits, both in-person (in very small groups) or virtually, through pre-recorded videos of plants and facilities

- Data rooms – little to no change as these are universally done via online software

Getting to closing

Another area in which more change has been witnessed is between signing a letter of intent and closing. Because travel has been restricted for many buyers and service providers, time to closing typically has increased in most transactions, but some deals still are closing on a “pre-COVID” timeline. Every transaction that we have closed during the pandemic has had at least one face-to-face meeting between buyers and sellers. In addition, most have required environmental surveys and site visits prior to closing. The logistics for these visits have required more robust advance planning.

Purchase agreement nuances

COVID-19 also has made buyers focus on certain areas of due diligence and created new conditions to closing. While buyers consistently have emphasized safety, they are evaluating workplace safety and health procedures more thoroughly. There has been renewed evaluation of employee interactions, given the potential for rapid spread among work groups, and even company/customer interactions. In addition, Paycheck Protection Program (PPP) loans have become a key item of negotiation between buyers and sellers. Even if the loans are expected to be completely forgiven, a change of control may accelerate the loan and require it to be repaid at closing or that funds be escrowed in the remote chance it is not forgiven. In summary, several of the major changes in purchase agreement negotiations during COVID-19 have included:

- PPP Loans

a. Seller(s) may have to represent that the company was eligible for the PPP loan and that the proceeds were used in accordance with program’s guidelines.

b. Requirement that PPP loans be repaid prior to or at closing or have funds escrowed in the loan amount. If the loan is forgiven, escrowed funds would flow to the seller(s).

2. Material Adverse Change (MAC) and Other “Outs”

a. Sellers have added a MAC exclusion for issues related to COVID-19.

b. Buyers have added financing outs if “solely” related to impact of COVID-19.

3. Health-Related Conditions

a. Certain purchase agreements may include a condition that no more than a certain number of employees are sick with COVID-19 at closing. A number of jurisdictions are requiring companies with a threshold level of infections to close for a period of time. Buyers want to ensure that they do not close on a transaction where the target effectively is closed for several weeks.

Navigating M&A processes during a pandemic has created new challenges and issues to consider, but clients have continued to achieve successful outcomes. Proper planning and execution are paramount to this success.

Todd Parsapour is the investment banking managing director for Stout, a global investment bank and advisory firm specializing in corporate finance, valuation, financial disputes and investigations. The firm serves a range of clients, from public corporations to privately held companies in numerous industries. Stout’s clients and their advisors rely on the firm’s premier expertise, deep industry knowledge and unparalleled responsiveness on complex matters.

More information: www.stout.com