by Michael Benson, managing director, Stout

One of the key decisions a business owner will face is when and how to address a major ownership transition. Owners facing this decision may find that their interests begin to diverge from the interests of the company and will need to weigh the importance of generating liquidity and maximizing the valuation of the business against other considerations, such as business continuity and continued investments in the business.

This article will cover the concept of corporate and shareholder objectives, which when unaligned can lead to the need for some form of a transaction. In addition, it will present a variety of strategic alternatives to consider when striving to satisfy all relevant stakeholders in a transaction.

Corporate and Shareholder Objectives

While considering an ownership transition, there is a need for business owners to recognize corporate objectives and shareholder objectives as distinct from one another.

Corporate objectives consist of what the management team and employees of the business want: A competitive position through acquisitions and/or internal growth, access to capital, financial flexibility and maximized shareholder value.

Shareholder objectives, overlapping but distinct from corporate objectives, tend to consist of minimized dilution, an acceptable risk/return profile, liquidity and a maximized shareholder value.

The potential conflicts between these two may become evident as ownership ages. At the genesis of a company, a younger business owner typically has an appetite for growth and a higher tolerance for risk-taking. Liquidity is less important, the company has a seemingly infinite time horizon and the owner is not planning to take capital out of the business in the near term. These dynamics keep corporate and shareholder objectives aligned.

However, as owners age, they may become more risk averse, even seeking to take capital out of the business as they plan for retirement. This can lead to conflict when a company’s management team desires aggressive growth, but older ownership is hesitant to take risks such as large acquisitions or significant capital investments.

As more people become involved, the process of aligning corporate and shareholder objectives becomes more difficult. More stakeholders mean more complexity in aligning objectives, which can be compounded when ownership is family and personalities or rivalries threaten objective decision-making.

Timing an Ownership Transition

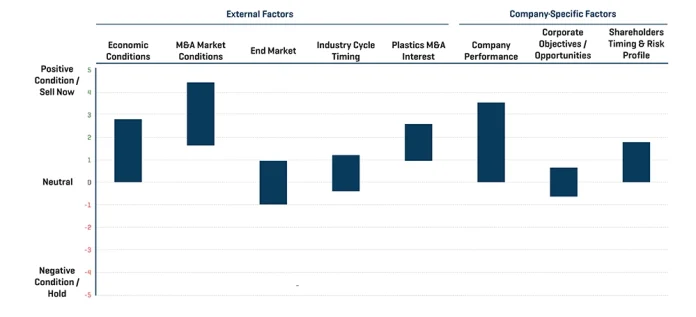

Ultimately, a combination of external and company-specific factors determines the right time for an ownership transition.

External factors include economic conditions, the strength of both the M&A and end market, and industry cycle timing. Company-specific factors consist of the company’s performance, corporate objectives/opportunities, and the shareholders’ timing and risk profile. Figure 1 illustrates how these external and company-specific factors can align – or not align – to influence transition timing.

The goal for owners is to look ahead for as much alignment between these factors as possible, leading to a maximization of both value and opportunity for a company sale.

Shareholder/Stakeholder Considerations

Understanding the profile of a company’s shareholders and stakeholders will determine which strategic alternative is best. These considerations include the shareholders’ risk tolerance, the strength of the management team, the role of the family in the business and the seller’s openness to operational changes the buyer will make. Additional factors consist of the shareholder/stakeholder timing to exit, the importance of maximizing company value and how quickly sellers want their money.

Maximizing value in an individual- or member-owned company sale often plays less of a role than expected. The price paid for the deal often will be between a quarter million and a million dollars lower than maximum value because of other factors, such as the next owner’s plans for the company.

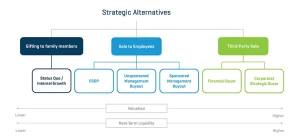

Examining Strategic Alternatives for an Ownership Transition

As shown in Figure 2, the range of strategic alternatives includes an ESOP transaction, unsponsored and sponsored management buyouts, and sales to private equity or strategic buyers. Each alternative offers advantages and drawbacks.

ESOP Transaction

In an employee stock ownership plan (ESOP) transaction, an ESOP trust is formed and borrows debt to purchase shares over time from shareholders. Because a company only can handle so much leverage, this usually is done in three stages of four- to five-year tranches. A third of the business is bought, and once the debt is paid off (likely in four to five years), the next third is purchased, and so on.

This allows ownership of the business to be transferred to employees over time and often causes employees to feel rewarded for their work. An additional advantage of an ESOP structure is that the ESOP trust is tax-exempt so effectively the company does not pay taxes.

However, an ESOP transaction can lead to limited liquidity at the sale since ownership typically is going to get only a third of the business value at closing. Plus, the debt used to acquire the company alternately could have been deployed for growth. Additionally, such a transaction typically doesn’t maximize value, and the previous owners must be careful to not overvalue the business as it is being sold to the employees.

Unsponsored Management Buyout

In an unsponsored management buyout, ownership of the business is transferred to the management team without any outside equity. The purchase usually is undertaken through a combination of management equity (any money that management is able to invest personally), third-party financing (such as bank financing) and a seller note (which essentially is money owed to the former owner that is repaid over time).

This approach allows for business continuity, as there is very little disruption to business operations. However, the seller is not realizing much liquidity at the point of sale and retains a significant amount of risk exposure since the seller will be paid back over an extended period.

Sponsored Management Buyout

A sponsored management buyout occurs when private equity purchases ownership in the company. Management still is able to retain ownership but only as much as they are able to contribute in equity. Many times, private equity will offer equity incentive plans, allowing management to earn additional equity over time.

A sponsored management buyout allows for a higher near-term valuation and the potential for complete liquidity, depending on the percentage the private equity firm and management team can acquire.

Depending on the situation, though, the timeline of the sale can be a disadvantage. Private equity may need a longer transition period, especially if the selling shareholder is important to the business. This transition may take 12 months, and in some cases, even 24.

Sale to Private Equity

In a sale to private equity, the degree of alignment between management and the buyer largely will determine the success of an ownership transition. In any buyout, there will be complications if management is not aligned with the new ownership.

Advantages of a sale to private equity include the potential for partial or complete liquidity and the ability for the owner to maintain an ownership stake. Shareholders can pursue future goals with the help of a capital partner. However, the transition can take at least 12 to 18 months, and there is the possibility of significant operational changes being made to the company.

Sale to Strategic Buyer

A sale to a strategic buyer is the most straightforward, as the buyer acquires the company outright. This leads to a high near-term valuation, the potential for complete liquidity and little to no risk to shareholders while offering a very short transition period. However, owners receive no exposure to any future upside in the company.

In addition, since these often are sales to competitors (though not always), there is high potential for significant changes being made to the company following the transaction.

Owners may fear sales to strategic buyers, especially competitors, since it introduces the possibility of current management being removed or significantly restructured. It’s not always the case, but addressing this topic can require strong alignment between buyer and seller.

In the end, both private equity and strategic buyers are looking for good, talented people. If a company has a strong management team that is leading with strategic intent, maintaining a strong culture and taking on risk, the buyer of that business is going to want that management team to remain.

Business owners face a wide variety of strategic alternatives when it comes to transitioning their company to new ownership. Corporate considerations, such as a desire for growth and capacity to take on debt, interact with shareholder considerations, such as timeline or liquidity concerns and whether the outcome of the transition will have a significant impact on the future of the company and its employees.

Business owners who see such a decision coming down the pipeline, even several years away, would do well to begin planning to ensure they have the time to identify and execute the ideal strategic alternative for their specific situation.

Stout is a trade name for Stout Risius Ross, LLC, Stout Advisors SA, Stout Bluepeak Asia Ltd., Stout GmbH, MB e Associati S.r.l., Stout Park Ltd, and Stout Capital, LLC, a FINRA-registered broker-dealer and SIPC member firm. The terms “Stout” or the “firm” refer to one or more of these legally separate and independent advisory practices.

Michael Benson is a managing director in the Investment Banking group at Stout. He is responsible for the execution of investment banking transactions which include mergers, acquisitions, divestitures and the private placement of senior debt, subordinated debt and equity securities. Benson has been involved in the successful completion of transactions for companies ranging from privately held, middle market companies to large multinational, publicly traded corporations. Additionally, he has been involved in restructuring projects, which range from providing strategic advisory services to underperforming companies to the sale and liquidation of companies both in and out of bankruptcy.

More information: www.stout.com/about