by Marcella Kates, marketing director, MAPP

Manufacturers have faced historically challenging issues in the past three years, including a chaotic and unpredictable supply chain network, increasing resin prices and lead times, a national labor shortage, an unpredictable international pandemic that disrupts the global economy and the highest inflation rate since November 1981 (9.1%). To support plastics processors, the Manufacturers Association for Plastics Processors (MAPP) recently published its annual Wage and Salary Report, the leading compensation analysis attentive to the United States plastics processing industry.

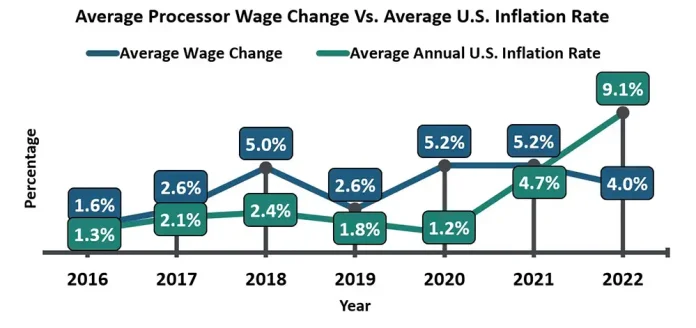

The 2022 Wage and Salary Report represents compensation data for 223 plastics processors across 37 states to provide a 10-year trending compensation analysis for 68 unique job positions. This report also represents nearly 25,000 full-time and part-time employees. Fifty-three of the 68 positions (78%) experienced an average increase of 5% in 2022, while the remaining 14 jobs experienced an average decrease of 3%. The highest salary increase was for automation technicians at 19%, and the most significant reduction was for warehouse Managers at a 4% decrease. The average salary change for all the reported positions was an increase of 4%, which is less than half the current United States inflation rate. For the first time in seven years, the average annual US inflation rate has surpassed the average wage increase provided by plastics processors in MAPP’s annual Wage and Salary Report. Since August 2021, the US inflation rate has increased each month, reaching a new 40-year high of 9.1% in June 2022.

The 2022 Wage and Salary Report represents compensation data for 223 plastics processors across 37 states to provide a 10-year trending compensation analysis for 68 unique job positions. This report also represents nearly 25,000 full-time and part-time employees. Fifty-three of the 68 positions (78%) experienced an average increase of 5% in 2022, while the remaining 14 jobs experienced an average decrease of 3%. The highest salary increase was for automation technicians at 19%, and the most significant reduction was for warehouse Managers at a 4% decrease. The average salary change for all the reported positions was an increase of 4%, which is less than half the current United States inflation rate. For the first time in seven years, the average annual US inflation rate has surpassed the average wage increase provided by plastics processors in MAPP’s annual Wage and Salary Report. Since August 2021, the US inflation rate has increased each month, reaching a new 40-year high of 9.1% in June 2022.

MAPP’s latest publication of the Wage and Salary Report includes numerous format, content and analysis improvements from last year. Historical employment and benefits data now is provided to demonstrate the current trends in the plastics processing industry.

MAPP’s latest publication of the Wage and Salary Report includes numerous format, content and analysis improvements from last year. Historical employment and benefits data now is provided to demonstrate the current trends in the plastics processing industry.

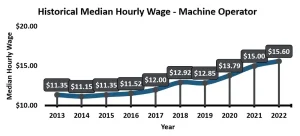

Compensation data is dissected by total annual revenue and the four major US regions: West, Midwest, South, and Northeast. The historical median hourly wage is included for 63 of the 68 positions, and the data dates back as far as 10 years (2013). For example, the graph below illustrates that the median hourly wage for machine operators has increased by 37% in the past 10 years.

In addition to increasing employee compensation levels, plastic processors also have dealt with historically high turnover rates. Thirty-five percent of the surveyed population reported having a turnover rate of between 5% and 14.9%, a 10-point increase since 2018. Additionally, one-third of processors reported having a turnover rate greater than 25%, the highest percentage reported in the past five years. Additionally, 6% more processors reported having employees who satisfy multiple job functions in 2022 than in 2021, possibly due to the gaps in employment. According to MAPP’s second Quarterly Pulse Report for 2022, larger plastics processing companies are experiencing more severe employee turnover than smaller companies. On a scale from 1 (extremely poor) to 10 (excellent), processors with less than $5 million in annual revenue reported the highest average rating of 5.4 out of 10, while processors with more than $50 million in annual revenue reported the lowest average rating of 3.6.

The current employee turnover challenges come at a time when it seems that most management teams are working their hardest to modify retention tactics to improve how employees view their companies. These tactics range from eliminating attendance policies and paying bonuses for showing up to work on time for a week to “work when you want to work” schedules.

Although the issues associated with wage inflation and recruitment/retention challenges are significant, seasoned executives express sentiment that strong market demand outweighs issues associated with labor.

To discover the latest wage and compensation rates along with the most recent workforce management benchmarks covering shift differentials, overtime, PTO and more, go to mappinc.com/resources/benchmarking.