by Will Hinshaw, partner/founder, Captive Solutions & Options

Insurance reporting is wrought with charts and graphs that document figures, percentages and acronyms that are difficult to understand in terms of cause and effect. Rarely do they drive clarity and action. However, those disparate reporting sources can be simplified to a single metric that links to what business leaders care about – cost! This single metric can help leaders evaluate options, monitor progress through the process and assess the impact to the health benefit plan accordingly for the next year. This “magic number” is Total Cost Per Employee Per Month (PEPM).

Total Cost Per Employee Per Month

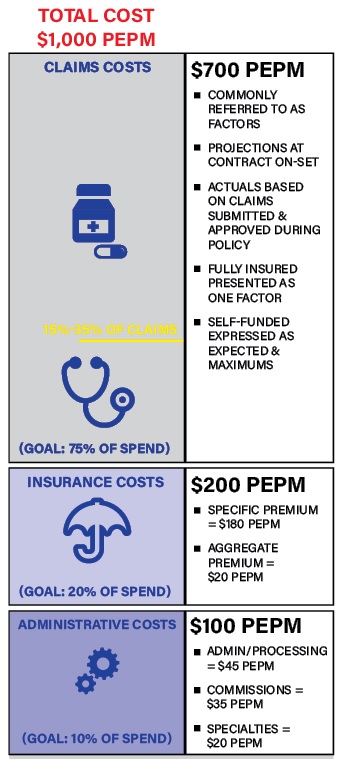

Healthcare spend is based on the sum of a multitude of unit costs. These unit costs then are consolidated and summed based on an enrolled employee – hence the term Per Employee Per Month. This methodology is necessary because employee enrollment varies from month to month. These unit costs are grouped into three “buckets” of spend: administrative costs, insurance costs and claims costs. Image 1 depicts a total cost PEPM, while the buckets categorize the metrics and the unit costs that commonly are included.

Using PEPM to evaluate options

At the onset of an annual insurance contract, PEPM can serve as the basis for calculating projected total cost, as well as comparing each bucket of spend. The insurer – for either a fully insured or partially self-funded plan – and the advisor or broker will be able to consolidate total cost into a single PEPM. While this is an excellent point of comparison that levels the playing field between demographics, plan designs, service delivery and cost containment programs, the components of the PEPM illuminate valid points of comparison. The mix of spend articulated via the percentage for each bucket further highlights the points of comparison. Some will espouse minimal fixed costs, so claims coverage is maximized. Others will counter that greater fixed costs reduce the volatility during the policy year.

The goal is to simplify the process to allow for a targeted assessment, which leads to action. Total cost PEPM and the percentages associated with each bucket, in conjunction with the rates and factors that make up those percentages, are excellent tools to create a measurable comparison. While the comparison is not “apples to apples,” it will provide insight that can lead to better outcomes. As with any business decision, the choice is the risk vs. the reward criteria, which is specific to each company.

Using PEPM to monitor performance

Where the total cost PEPM really shines is in a monthly snapshot vs. the contract, budgeting and/or additional benchmarks. Given that the rates associated with service delivery and insurance premium are fixed at the contract onset, the monthly review should focus on the claims PEPM, as it calculates into the total cost PEPM. During policy updates, the claims PEPM should be broken down into medical and pharmaceutical claims, which easily can be measured and compared year-over-year, month-to-month, vs. projections to determine if further research is warranted.

For example, given an increase in the monthly total cost PEPM vs. the projected monthly average, leadership easily can assess if the driver is increasing medical or pharmaceutical claims based on their PEPM values. If the increase is in medical claims, a quick analysis should identify the top three costs based on PEPM. Depending up on the outcome of this quick analysis, a company can determine the course of action to address the rising costs.

One area of increasing cost, but easily monitored via the PEPM, is pharmaceutical claims. In addition to understanding the year-over-year costs, there are many national benchmarks for pharmaceutical PEPMs, which brokers or advisors can provide. A number of innovative and well-established cost containment programs exist to effect change, and the vast majority of today’s programs focus on how and where to source the prescription. These international sourcing and/or patient assistance programs can drive savings from a moderate 10% to an astounding 100% subsidy. The awareness generated by PEPM monitoring can lead to specific tactics to lower costs.

The complex nature of the healthcare delivery system quickly can lead to dizzying levels of detail that are difficult to assimilate into a traditional business decision-making process, which is why understanding total cost PEPM is necessary and beneficial to navigating through today’s healthcare challenges.

Will Hinshaw has dedicated over 25 years to leading organizations to profitable growth and superior service delivery in numerous industries over the years, including healthcare delivery, pharmaceutical, and mergers and acquisitions. For more information on the “Magic Number” or healthcare spending in general, please contact Susan Denzio, [email protected].