by Laurie Harbour, president and CEO, Harbour Results

The COVID-19 pandemic has made one thing clear: Not every manufacturer is going to come out of this crisis intact. The industry has experienced a significant impact, causing ripples throughout the supply chain. And, if a business went into 2020 in a weakened state, it’s really going to show on the backside of this year.

Ramping back up will certainly be a major challenge for the industry. Nearly all companies will be slowly restarting operations – first for OEMs and then suppliers. In North America, most manufacturers began operations in May with limited or staggered shifts and other safety precautions in place. While this ultimately is a step in the right direction, the reality is the industry still is facing serious headwinds as restrictions on public life remain in effect and will continue for some time. In fact, the marketplace will not return to normal until a COVID-19 vaccine is in place, which clearly will not occur in the near future.

For now, the key questions we face are “What is the business going to look like when operations resume?” and “What do we need to do to better prepare the company for success?”

Challenges facing manufacturers

Companies will face a number of challenges as a result of this crisis. To start, a global recession is here. A recession to this extent is something we have not experienced in recent times – and, frankly, we don’t have a clear picture of how quickly the economy will rebound or if we can expect future recessions in the next two to five years.

Additionally, looking at most industries – automotive, recreational vehicles, aerospace, etc. – we can expect a 50% to 60% drop in production for the remainder of the year. As ramp-up activities proceed, suppliers also can expect business inconsistencies due to products and launches being modified or even canceled while others become a priority. Also, raw materials and supplies may be in short supply. In the end, companies with good supplier relationships will likely have an advantage as the supply chain opens up.

Internally, reengaging a workforce safely could be difficult and costly. Additional resources to ensure safety standards are in place will be needed, and it is highly likely many employees will be nervous or unwilling to return until the pandemic is better under control. In fact, those who are close to or at retirement age may decide not to return at all – or they might decide to stay longer because of the impact on their 401(k).

And finally, cash. It has been a continuing edict since this crisis started: Conserve your cash. Doing so will continue to be a challenge for manufacturers. Cash will be required to operate and meet customer demands, so companies need to be conservative because there is no clear picture as to how long the ramp-up will be or – even worse – if there could be a second wave of the virus forcing future shutdowns. Those who applied and received the Paycheck Protection Program loan should not become complacent and instead work to ensure those funds are used strategically and not just for labor forgiveness.

Preparing your business

One of the most critical factors to a company’s long-term outlook is the response of leadership, and this situation is going to challenge leaders now more than ever. As we transition to a different phase of the crisis – reopening – leadership must focus on several aspects.

Align with Customer Demand

Companies must have ongoing communication with their customers so that business operations align with supplier demands. Shops need to expect and prepare for variability and change, ensuring operations are flexible and conservative so as not to burn cash. For example, when looking at bringing back your workforce, understand what number is needed to achieve required utilization, remembering that you can flex up or down within a revenue range with limited additional resources.

Drive Operational Efficiency

Continuous improvement always should be a foundational element at shops, but in today’s crisis, looking for unique ways to drive efficiency will be absolutely critical for success. Bring back employees who can help you achieve the necessary gains. Challenge every aspect of the business to determine the best course of action to decrease production costs while maintaining or improving efficiency. If you have two facilities, do you need to open both? Or can you temporarily focus operations in one facility? Can you leverage work-from-home protocols to drive down infrastructure costs? Can you revise roles and responsibilities to better utilize indirect labor? Can you reduce and stretch your administrative staff to do more with less? In general, be creative and challenge everything. Consistently ask, “Why?”

Leverage Technology and Automation

Shops must maximize the current technology and automation in place to improve efficiency and limit the number of employees utilized. Businesses must find avenues to run their operations with technology at the forefront. And, although this may seem strange, leadership should be looking at how smart investments in technology could improve operations, and based on what they find out, make a plan.

Focus on Workforce Readiness

Although often overlooked, workforce readiness is incredibly important for leading through this crisis. Companies need to take advantage of this time to look at the entire workforce and make a plan for what talent they need to bring back, where to trim and where they have gaps. Additionally, plans must be put in place to reengage the workforce and bring them back safely, as well as how to handle those who don’t want to come back for health concerns. And, some shops may want – or need – to consider incentives, including bonus or hazard pay, to encourage people to come back to work.

Think Strategically vs. Tactically

Last but not least, leaders need to move from short-term tactical planning to long-term strategic planning that will allow their businesses to align supply with demand. The COVID-19 pandemic is going to have a lasting impact on the economy and the manufacturing industry. Company leaders need to be planning for the remainder of 2020 and 2021 with revised production numbers. Those with strategic plans in place need to revisit and update. And, for those that don’t, now is the time to sit down and put a plan in place. Everyone should be collecting market intelligence to help them understand what is happening in the industries they serve and with the economy, and then planning accordingly.

Sales have been and will continue to be difficult but should be a big part of strategic planning. Leadership needs to challenge its sales team to be creative and try tactics that may not have worked in the past but could provide opportunities in this new, evolving climate.

There’s no question the industry will undergo significant changes as a result of this pandemic. On a more holistic level, there is the opportunity for positive change. Hopefully, this will be the shift in the industry that we’ve been waiting for. This includes businesses implementing new technologies and automation strategies, embracing a flexible workplace and placing a greater emphasis on keeping employees safe and healthy.

The economic impact of the pandemic is going to be felt through December, and it will be sometime in the first quarter of 2021 when we start to see a rebound in the manufacturing industry. However, this rebound likely will be slow. Those leaders who step up, maintain their composure, continue to communicate with their team and look at every aspect of the business and how they can uniquely address challenges are the ones who will be best positioned for success through this very difficult situation.

As president and CEO of Harbour Results Inc. (HRI), Laurie Harbour leads a team of analysts and manufacturing consultants to help small- to medium- sized manufacturers develop short- and long-term strategies, improve their operations, reduce risks and optimize business.

More information: www.harbourresults.com

Manufacturing Industry Utilization Drops Significantly

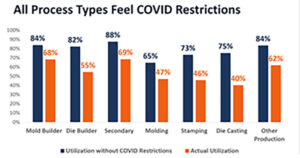

Harbour Results, Inc., (HRI) conducted a study to better understand how the COVID-19 pandemic is impacting small- to medium-sized manufacturers – both production and tooling. The results show that nearly two-thirds of those shops surveyed are operating at some level of reduced capacity or are closed. The industries experiencing the highest level of impact are the automotive and home appliance industries – on average, those shops in automotive have laid off 41% of its workforce. Additionally, across all manufacturing processes, companies have indicated that utilization has dropped from as little as 18 percentage points to as much as 35 percentage points.

Harbour Results, Inc., (HRI) conducted a study to better understand how the COVID-19 pandemic is impacting small- to medium-sized manufacturers – both production and tooling. The results show that nearly two-thirds of those shops surveyed are operating at some level of reduced capacity or are closed. The industries experiencing the highest level of impact are the automotive and home appliance industries – on average, those shops in automotive have laid off 41% of its workforce. Additionally, across all manufacturing processes, companies have indicated that utilization has dropped from as little as 18 percentage points to as much as 35 percentage points.