Essential to understanding the evolution of the polymer 3D printing industry is exploring the change from low-cost printing technologies and materials to the slow growth and adoption of innovative polymer printing technologies and materials, from viscous thermosets to carbon fiber composites to foams. While several new technologies and materials have originated from legacy players like Stratasys and 3D Systems, many have been created by startups looking to push polymer AM’s boundaries in its capabilities and applications.

In IDTechEx’s market report on 3D printing, “Polymer Additive Manufacturing 2023-2033: Technology and Market Outlook,” the polymer AM industry is forecast to rise to over $21 billion by 2033. This technical market report includes 85 forecast lines across polymer hardware and materials and over 50 company profiles from promising startups to market leaders, material players, and more. This was completed with an extensive number of primary interviews to bring the reader the latest and most accurate information.

In doing this primary research, IDTechEx has identified many startups looking to improve every aspect of the polymer AM supply chain, from hardware to software to materials; some are even acting as vertical integrators to deliver parts made with innovative AM technologies straight to end users. This article explores a selection of these innovators; further discussion on emerging players can be found in IDTechEx’s report on “Polymer Additive Manufacturing 2023-2033: Technology and Market Outlook.”

Innovators in Polymer AM Hardware

Many polymer 3D printer manufacturers have sought to address the throughput concerns inherent with additive manufacturing with varying degrees of success. One of the more unique approaches has been pioneered by Evolve Additive Solutions, who developed a technology called Selective Electrophotographic Thermoplastic Process (STEP) that combines elements of powder bed fusion, sheet lamination, and 2D laser printing. With STEP, a layer is imaged onto a charged drum, where the imaged areas become discharged. The drum passes through a bed of charged thermoplastic particles, picking up a layer of particles onto the drum matching the image. This layer is passed onto a conveyor belt and taken to the build platform, where the layer is aligned with and fused to the part using heat and pressure. Through STEP, a very high build rate can be achieved (a maximum of 100 cm3/hour), which Evolve Additive states enables their Scalable Volume Production (SVP) printers to more convincingly compete with injection molding at medium-high part volumes.

Meanwhile, developers of volumetric additive manufacturing look to flip the current 2.5D layer-wise nature of additive manufacturing on its head. VAM consists of a group of technologies that print a 3D object in a single step, rather than printing 2D slices layer-by-layer to create a 3D object; importantly, VAM potentially enables significant improvements in 3D printing speed and surface finish, two persistent issues for polymer additive manufacturing. Two startups commercializing VAM are Xolo and Readily3D, who are developing the respective VAM technologies: Xolography and Tomographic 3D Printing. While Xolo focuses on photopolymer resins, Readily3D focuses more on biocompatible materials for medical applications, like photosensitive acrylates, silicones, and hydrogels. A key challenge for both will be overcoming the typical material limitations of 3D printable photosensitive materials. Still, VAM presents an interesting opportunity to address two critical drawbacks of 3D printing and potentially access new applications.

Innovators in Polymer AM Materials

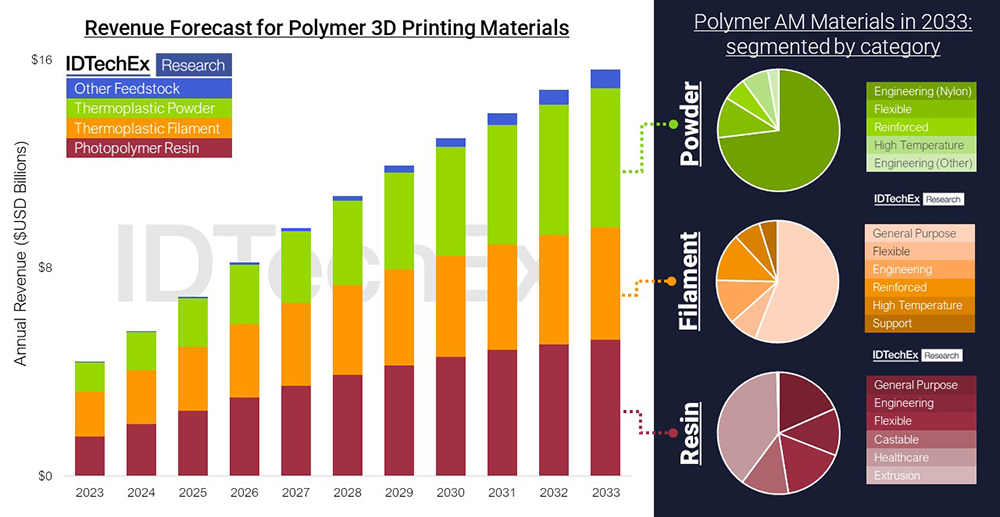

Speaking of material limitations, polymer 3D printing materials contend with many; materials players across the industry look to address these limitations, given the importance of 3D printing materials to the market. According to IDTechEx forecasts, polymer AM materials revenue has surpassed that of polymer AM hardware sales and will grow past $15 billion by 2033. These forecasts from IDTechEx break down how polymer AM materials will evolve over the next 10 years.

Different startups look to address different challenges inherent with polymer AM materials, whether they be cost, performance, or sustainability. For example, AlphaPowders is looking to reduce the cost of thermoplastic powders, which IDTechEx forecasts to be the most in-demand type of polymer AM materials by 2033. Materials cost is a major concern for end-users, given that 3D printing materials can be more than ten times the cost of their injection molding equivalent. AlphaPowders are hoping to reduce these costs by developing equipment that converts cheaply synthesized thermoplastic powder into AM-grade powder, thus lowering the end price per kilo for AM thermoplastic powder.

While polymer 3D printing is often assumed to be unsuitable for end-use functional applications, startups making high-performing materials like Tiamet3D look to break that barrier down. Tiamet3D hopes to make 3D printing of performance parts more accessible through their composite PLA filament incorporating nano-diamonds.

Lastly, sustainability in manufacturing is a major consideration for players across all verticals, from automotive to consumer goods to aerospace. While 3D printing reduces materials waste in general, most polymer 3D printing materials are derived from fossil-fuel-based feedstock. Looking to increase the sustainability of polymer 3D printing materials is startup Reflow, who have developed a filament production process using recycled plastic. According to Reflow, their recycled PETG (polyethylene terephthalate glycol) filament has attractive material properties while making use of recycled PET plastic feedstock. The growth of sustainable materials for 3D printing adds a new dimension to the sustainability discussion taking place in the additive manufacturing industry.

Innovators in Polymer AM for Part Production

A growing segment of innovators in polymer AM are using their own proprietary hardware and/or materials to supply parts directly to end-users. Not only do these startups innovate on their printing technology and feedstock, but they’re also innovating with their choice of business model, a change from the classic 3D printer manufacturer. One example is Bond3D, who are supplying parts made from their high-temperature thermoplastic rod extrusion technology that reduces voids and increases end-part performance. Another example is Arevo, whose continuous carbon fiber composite extrusion technology has been applied in the sporting goods and furniture industry. Some startups have been built to target specific applications, like OPT Industries, whose roll-to-roll stereolithography approach (RAMP) uses mechanical metamaterials to make nasal swabs for biomedical applications. Regardless of the technology or applications, it is clear that these polymer AM startups are exploring new ways of getting polymer 3D printed parts into end-users hands.

This article shows the range of activity taking place in the polymer additive manufacturing market. For detailed profiles on many of the companies mentioned in this article and many more, please see the IDTechEx report “Polymer Additive Manufacturing 2023-2033: Technology and Market Outlook.” This report gives a targeted analysis of this industry, providing the latest forecasts with key technical insights.

For more information on this report, please visit www.IDTechEx.com/PolymerAM. For more information, contact research@IDTechEx.com or visit www.IDTechEx.com.