by David Evatz, managing director, Stout

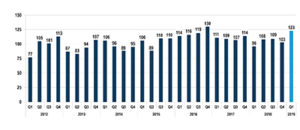

In the first quarter of 2019, 123 plastics industry M&A transactions took place, a 28% increase year over year (YOY). The number of transactions during the quarter was also the second-highest quarterly total over the past seven years. Industrial plastics led the charge during the quarter with a 49% increase YOY, while automotive and medical plastics also saw meaningful increases.

From a process perspective, the three largest categories saw increases with resin/compounding, injection molding and extrusion transactions increasing 33%, 25% and 12%, respectively, YOY. From a seller’s perspective, corporate carveouts and privately held businesses saw increases of 75% and 32%, respectively, while private equity sales were down.

All three buyer types (strategic, hybrid and financial) were up for the quarter, as continued interest for plastics businesses came from all types of buyers. In addition, there was a 46% increase in domestic transactions YOY, while international transactions saw a 17% increase.

Key Q1 2019 themes

- Plastics industry M&A activity increased relative to an already-high level of demand.

- The stock market rebounded during the quarter and overall valuation levels remain at or near all-time highs.

- Cost of capital remained low, and levels of availability remained high.

- Key macroeconomic indicators remained strong.

- Industrial, automotive and medical transactions increased.

- Corporate carveouts and privately held plastics businesses saw increased M&A.

- Resin/compounding, injection molding and extrusion saw increased M&A activity.

- Domestic and international plastics M&A activity increased.

Stout Proprietary M&A Database Highlights

Buyer and seller trends

All buyer types saw similar increases during the first quarter of 2019. Strategic, hybrid and financial buyer plastic M&A activity increased 30%, 29% and 21%, respectively, during the quarter YOY. On the sell side, corporate carveouts saw the largest jump with a 75% increase during the quarter YOY. Private sellers (the largest seller segment) also saw gains with a 32% increase YOY, while private equity sales decreased 29%.

End market activity

Industrial plastics M&A activity was the biggest driver in the quarter with a 49% increase YOY. Within the industrial plastics segment, most process types were up, though resin/compounding, injection molding, machinery and distribution were particular bright spots. Smaller segments within plastics M&A, including automotive and medical, also saw increased activity during the quarter. Plastic packaging, the second-largest segment, decreased 11% YOY.

Activity by process

M&A activity involving eight out of the 10 plastic processes tracked by Stout were flat or up during the quarter. Bright spots included resin/compounding, injection molding and extrusion, as well as some of the more niche areas such as thermoforming, machinery and distribution.

Activity by geography

Domestic plastics M&A activity saw a significant increase during the quarter, up 46% YOY. International plastics M&A activity was also up 17% for the quarter YOY, while cross-border transactions were flat. Within the US market, plastics M&A activity saw the biggest gains in the industrial and automotive end markets, as well as the injection molding, resin/compounding, machinery and distribution segments.

Market Trends

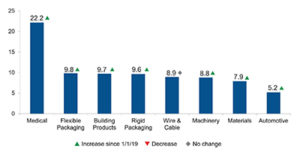

Plastics industry multiples

Overall stock market performance rebounded in the first quarter of 2019 after the correction at the end of 2018. Generally speaking, most public companies and indices continue to be at or near all-time highs. For the first three months of 2019, the Dow Jones Industrial Average was up approximately 11%, while the S&P 500 and Nasdaq were up 13% and 16%, respectively. Within the plastics industry, all public company segments continue to maintain relatively high valuation levels, with all eight plastics industry sectors that Stout tracks increasing during the quarter.

Macroeconomic metrics

Key macroeconomic indicators, including GDP, consumer confidence, unemployment and other metrics remained strong during the quarter. Capital markets continue to be favorable for M&A activity, and a relatively low cost of capital environment remains. Crude oil prices increased 33% during the quarter, while natural gas prices were down 7%. Resin pricing for commodity plastics generally declined during the first three months of 2019, while engineering-grade resins were generally flat.

David Evatz is a managing director in the Chicago office of Stout and head of the Plastics Industry Practice within the Investment Banking Group. He is a sought-after expert in the plastics M&A market with extensive experience executing M&A and corporate finance transactions of all types. Within the plastics industry, he has worked with companies serving the medical, packaging industrial and automotive markets, as well as for companies with various manufacturing and plastic processing capabilities. Email him at devatz@stout.com.

David Evatz is a managing director in the Chicago office of Stout and head of the Plastics Industry Practice within the Investment Banking Group. He is a sought-after expert in the plastics M&A market with extensive experience executing M&A and corporate finance transactions of all types. Within the plastics industry, he has worked with companies serving the medical, packaging industrial and automotive markets, as well as for companies with various manufacturing and plastic processing capabilities. Email him at devatz@stout.com.