by Ashley Turrell, membership & analytics director, MAPP

Wages continue to increase for plastics industry employees, and processors still are looking to hire, according to the most recent data published in the 2020 Plastics Industry Wage & Salary Report by the Manufacturers Association for Plastics Processors (MAPP). This year’s report reveals an average 3% increase in compensation, and about 80% of plastics companies are looking to hire in the next 12 months.

Wages continue to increase for plastics industry employees, and processors still are looking to hire, according to the most recent data published in the 2020 Plastics Industry Wage & Salary Report by the Manufacturers Association for Plastics Processors (MAPP). This year’s report reveals an average 3% increase in compensation, and about 80% of plastics companies are looking to hire in the next 12 months.

The 2020 Plastics Industry Wage & Salary Report, now in its 18th year of publication, analyzes data on compensation and employment trends in the plastics industry. By examining 60 different job titles, the report breaks down compensation information from more than 200 US-based plastics processors and represents data for more about 40,000 full-time and part-time employees across 30 states.

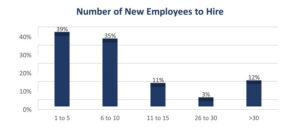

Amid the 2020 COVID-19 pandemic, it was uncertain how the landscape for manufacturers and their employees would shift. During the peak of the pandemic, less than 50% of plastics companies were able to maintain their standard employment levels. However, at the time of this publication, two-thirds of companies had reported their employment had returned to pre-pandemic levels. Additionally, 56% of manufacturers are trying to add staff in the next one to three months, and 80% are adding staff over the next 12 months.

To assist in recruiting and retaining employees, most plastics companies have continued to increase pay levels at or above current US inflation rates. Over half of the 60 positions included in the 2020 report showed an increase in pay above 1.3%, and 19% of jobs attained a compensation increase of more than 5%.

The increases are not “across the board,” however. Most of the positions experiencing significant increases are those technical and direct labor jobs, such as machine operators, machinists, delivery drivers, electricians, mold/die setters and set-up technicians. Consistently, these are the positions that plastics leaders have the most trouble hiring or retaining. Having a competitive pay and benefits structure in place for these positions is necessary given the level of demand and competition for employees to fill these roles. Additionally, 19 states that reported their data this year have mandatory annual minimum wage increases, further pushing up the compensation for many of these positions.

The increases are not “across the board,” however. Most of the positions experiencing significant increases are those technical and direct labor jobs, such as machine operators, machinists, delivery drivers, electricians, mold/die setters and set-up technicians. Consistently, these are the positions that plastics leaders have the most trouble hiring or retaining. Having a competitive pay and benefits structure in place for these positions is necessary given the level of demand and competition for employees to fill these roles. Additionally, 19 states that reported their data this year have mandatory annual minimum wage increases, further pushing up the compensation for many of these positions.

For only the second time in 18 years, staff-level positions were the least likely to experience an increase in their compensation. Furthermore, this year saw a decline in the median annual compensation for nine staff-level positions (general manager, engineering manager, HR manager, information systems manager, maintenance manager, plant manager, purchasing manager, quality manager and sales manager). In 2020, the combined median compensation for these roles was reported to be $830,206 – down $14,500 or 2%, from last year. This is most likely due to many companies freezing compensation or cutting compensation for salaried employees at the height of the pandemic.

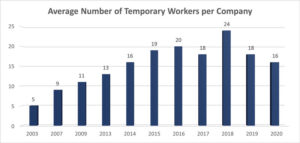

Plastics companies responding to this survey indicate they are looking to fill more than 4,400 positions over the next year – that number is up about 5% from last year. With numerous open positions and increasing turnover rates – the average turnover rate for plastics companies is 19% – many plastics companies utilize temporary staff to fill current demands. Forty-three percent of participants indicate that their company does use temporary help to fill gaps in staffing. However, the average number of temporary workers per company has dropped since 2019 – down to 16 per company. While temporary workers still are semi-standard for manufacturers, many companies avoided using temporary workers during the pandemic – either due to lack of access to workers or because of safety concerns involved with continuing to bring new people into the building.

Plastics companies responding to this survey indicate they are looking to fill more than 4,400 positions over the next year – that number is up about 5% from last year. With numerous open positions and increasing turnover rates – the average turnover rate for plastics companies is 19% – many plastics companies utilize temporary staff to fill current demands. Forty-three percent of participants indicate that their company does use temporary help to fill gaps in staffing. However, the average number of temporary workers per company has dropped since 2019 – down to 16 per company. While temporary workers still are semi-standard for manufacturers, many companies avoided using temporary workers during the pandemic – either due to lack of access to workers or because of safety concerns involved with continuing to bring new people into the building.

As companies have continued to learn, it takes more than competitive salary to attract workers of all levels. Companies also must offer intriguing benefits packages as well. While most companies (96%) indicate they offer insurance for employees, other benefits have helped to attract and retain their workforce. These include employee assistance programs, flexible work schedules, 401(k), childcare assistance, wellness programs, tuition reimbursement and profit sharing, to name a few.

While companies are hoping to return to normal by 2021, it will be critical again to create a compensation and benefits package that helps to attract employees back to manufacturing, using the data included in this report as a way to understand how they compare and compete against other US manufacturers.

For more information or to access the latest 2020 Wage & Salary Report, visit www.mappinc.com.