by Greg Alonso, principal, Plante Moran

The 2020 calendar year began with a solid, consumer-driven US economy, historically low unemployment and rising wages. The prevailing sentiment regarding near-term economic prospects was cautious optimism as the longest running recovery on record seemed likely to continue. Other significant events with economic implications included a ratified United States-Mexico-Canada Agreement (USMCA) and an oil war between OPEC and Russia. These pale in comparison to COVID-19, which has seized communities and caused unprecedented economic shocks, affecting market sectors and plastic processors in very different ways – bringing some to a virtual standstill (e.g., automotive) and driving demand spikes in others (e.g., consumer products, food and beverage, household cleaners, etc.).

The performance results of plastics processors in Plante Moran’s 2020 North American Plastics Industry Study (NAPIS) report precedes COVID-19 but continues recent trends of lower profit levels and slowing sales growth for plastic processors. We expect 2020 to exacerbate these trends, creating greater challenges for underperformers and potential opportunities for strong performers.

Unfavorable industry trends thin the ranks of ‘Successful Companies’

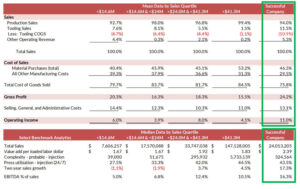

For 25 years, Plante Moran has been tracking performance and core competencies of Successful Companies. We define Successful Companies as those processors that achieve 10% earnings before interest and taxes (EBIT) margin, 15% return on assets and 5% sales growth. Successful Companies typically comprise approximately 10% of the total survey population. In the current survey data, 7% of the companies met the Successful definition. For comparison purposes, we have provided the mean values of quartiles for income statement line items and median values of selected benchmark metrics vs. Successful Companies. (See Chart 1.) Successful companies distinguish themselves from the rest of the industry through their ability to efficiently manage their labor costs as well as differentiated engineering and manufacturing capabilities that facilitate substantially higher profit margins and sales growth than the rest of the industry.

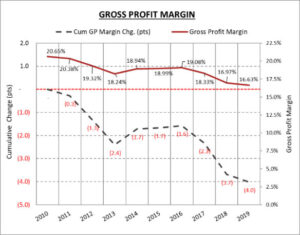

Charts 2, 3 and 4 show 10-year trend of key performance indicators for the overall health of the plastic processing industry: gross profit margin, value-add per employee and press utilization. Profit margins have declined by four percentage points over the last 10 years. The rate of decline did slow in 2019. We are concerned, in light of the COVID-19 crisis, that profit margin declines will accelerate if processors lose pricing discipline to keep their facilities busy. Processors should closely manage labor costs, as this tends to be more correlated with profit margins than other cost components.

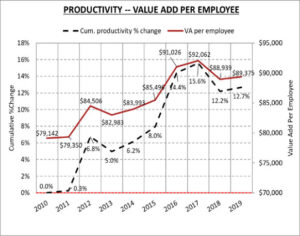

Processors have increased productivity by 12.7% over the last 10 years. Although it declined two years ago, it bounced back in 2019. The industry’s ability to offset the inefficiencies of employee turnover – which has risen consistently over the last five years – is notable. COVID-19 should limit turnover and flip labor markets from a “sellers” market to a “buyers” market for skilled and unskilled positions.

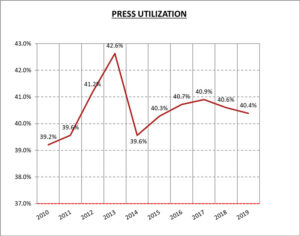

Utilization has declined slightly in recent years. Capital expenditures over the last five years have been at “maintenance levels” (capex = depreciation). Remaining useful life of capital assets has declined slightly over the last five years and is about 5.5 years. Plastic processors with a solid financial position and operations capabilities should see opportunities to consolidate business from low-performing companies as customers look to de-risk their supply chains. These opportunities to consolidate share should not require significant capex given capacity utilization levels.

Final thoughts and key considerations

The plastics industry will change substantially during 2020. We expect a shakeout in segments such as automotive – 50% of the companies in the survey are experiencing low-single-digit operating profits and earnings decline over the last two years. In addition to declining profits, processors’ revenue is highly concentrated: the median company requires six customers to achieve 80% of their revenue, and concentration subjects the typical processor to greater risk should one of its customers reduce orders or change suppliers. The recent government stimulus will help some processors through the current crisis, but processors also should closely manage their liquidity, assess their readiness for a second COVID-19 shock and strategically assess markets to diversify revenue.

Greg Alonso is a principal in Plante Moran’s strategy and plastics industry consulting practices. He has nearly 30 years of industry and consulting experience. Alonso manages the North American Plastics Industry Survey (NAPIS) and also advises senior management teams on strategic initiatives, including acquisition strategy, commercial due diligence, new market entry, product portfolio analysis and strategic planning.

More information: www.plantemoran.com