By Paula Leardini, senior analyst, plastic recycling, ICIS

On January 1, 2022, California’s minimum recycled content mandate for plastic beverage containers came into effect, contributing to the growing demand for recycled resins.

However, US recyclates supply is currently limited and expected to remain constrained in the short to mid-term.

- US availability of quality recyclates uncertain

- Price levels unclear

- ICIS modelling shows additional volumes required to meet recycled content mandates

Uncertainties exist on how companies will be able to source sufficient volumes of quality recyclates to meet their goals, and what price levels they can expect to face. ICIS modelling indicates that a significant increase in post-consumer resin (PCR) availability will be needed to meet demand driven by the California scheme. On September 24, 2020, California became the first US state to mandate a minimum recycled content in plastic beverage containers.

Manufacturers are required to include an annual average of 15% of post-consumer recycled (PCR) plastic in beverage containers governed by the state’s container deposit return scheme (DRS), or ‘bottle bill’. This is set to increase to 25% by 2025, and 50% by 2030.

According to The California Department of Resources Recycling and Recovery (CalRecycle), a branch of the California Environmental Protection Agency, the collection rate of polyethylene terephthalate (PET) bottles in California was 68% in 2020 while the US average was 27%, as reported by The National Association for PET Container Resources (NAPCOR).

Likewise, 54% of high density polyethylene (HDPE) bottles were collected in California in the same year versus a historical average of approximately 30% in the entire country, according to reports co-published by The Association of Plastic Recyclers (APR) and The American Chemistry Council (ACC).

Ten states in the US have bottle bill programs to encourage container recycling, including California. Under California’s Beverage Container Recycling Program, beverage containers are subject to a redemption value of five cents for containers less than 24 ounces, and 10 cents for containers 24 ounces or larger.

By comparing California’s collection rates with the US, it is clear how effective and important bottle bill programs can be as an alternative for improving waste management. California’s high bottle collection rates lead to a substantial supply of waste plastic bales available to the domestic market.

In the past, waste collected in the West Coast was largely exported to Asia. In contrast, the East Coast more heavily developed recycling capacity dedicated to the domestic market. However, with a rise in domestic demand for recycled polymers and the emergence of waste import bans in Asia, the export of US plastic bales has been declining over the last decade.

Beverage manufacturers have operations nationally, and brand companies may sell the same product into many markets, thus requiring companies to differentiate their products by state, or include PCR content in plastic bottles across the board.

In a recent industry debate during an ICIS Plastics Recycling & Circularity Conference, Stephanie Potter, sustainability strategy and corporate affairs at Nestlé, commented: “We are looking for consistency. We must move in the same direction and engage legislators to help with that”.

Regarding national policies, the Break Free from Plastic Pollution Act was reintroduced to Congress on March 25, 2021. The bill includes a nationwide minimum recycled content mandates for certain products, a national container deposit system, single-use plastic product bans, and an extended producer responsibility (EPR) program for packaging while protecting state and local governments that enact more stringent standards.

Despite the appeal of many in the industry for a uniform policy at both a federal and state level, pushback is expected from state legislators. Waste collection and recycling infrastructure can vary significantly by state, making it challenging to standardize mandates at the national level. Both regulatory and voluntary goals have been contributing to a growing demand for recycled plastics. However, supply is limited.

Feedstock availability is the main challenge for the plastic recycling industry across the globe. Expanding waste collection and sorting is essential to increase supply of not just volume but of high quality recyclates.

Brands have an essential role in contributing to increasing sustainability in the value chain. Aside from having to comply with such mandates on recycled content for beverage containers, Steve Alexander, president and chief executive officer at the Association of Plastics Recyclers (APR), highlighted brands are also the suppliers into the recycling chain. “They must act on design for recycling, participate in recycling programs, and connect with consumers”, he remarked.

Commitment on sortation is needed in a collaborative way by the industry and government to reduce plastic pollution as well as to secure plastic waste as feedstock for recyclers. Besides collection infrastructure, investment in recycling capacities also is needed to keep up with growing demand.

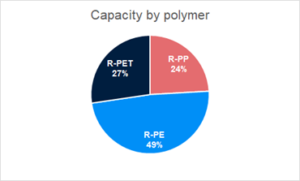

In terms of US installed mechanical recycle capacity, recycled polyethylene terephthalate (R-PET) and recycled polyethylene (R-PE) together have 75% share of the total, with a total of 5m tons in 2021, according to the ICIS Recycling Supply Tracker – Mechanical. These will be the main resins affected by the new Californian mandate as PET and PE together represent 97% of the US bottle market.

However, over 55% of the total US recycling capacity comes from post-industrial sources and the mandate focuses on post-consumer feedstocks only.

According to the ICIS Recycling Supply Tracker – Mechanical, almost 80% of R-PET originates from post-consumer feedstock sources while R-PE is only just above 30%.

When analyzing the availability of food grade resins to be used for beverage containers, the situation is even more critical. Only 20% of the total US recycling capacity is currently food grade.

Companies that wish to use recycled plastic for a food-contact application in the US must submit several pieces of information, including a description of both waste source and recycling process, results of tests that prove the process removes potential contaminants and a proposal of use conditions in the final application. Once submitted, the US Food and Drug Administration (FDA) then evaluates each proposal and provides companies with a Letter of No Objection (LNO), which is a recommendation as to whether the recycling process is likely to produce plastic that is appropriate for food-contact purposes.

Based on current supply data, ICIS has recently created an outlook model to calculate how much recycled resin is required to meet expected demand. The model includes demand as California’s minimum recycled content of 15% for 2022, 25% for 2025, and 50% for 2050. Virgin consumption is for resin used in bottles only, and for recycle output, the food grade post-consumer resin (PCR) production for bottles only.

As a result, an additional output of 800,000 tons of food grade PET and PE PCR resin would be needed to achieve 15% PCR content rate in bottles by 2022. By 2025, over 80 new recycling plants with an average output of 18,000 tons/year would be necessary to achieve 25% food grade PCR content in bottles. In addition, a Compound Annual Growth Rate (CAGR) of 45% in output would be needed to achieve 30% food grade PCR content rate in bottles by 2030.

As a consequence of the supply-demand imbalance, among other factors such as rising feedstock and production costs, recycled resin prices have been increasing over recent months.

Since mid-2019, food grade R-PET pellet prices are sold at a premium over virgin bottle grade PET in the US. Consequently, with price premiums anticipated to remain in the market during 2022, in order to comply with the California PCR content mandate, beverage manufacturers will have to pay more, either the recycled resin premium, that is if supply is available, or an annual administrative penalty of 20 cents for each pound of PCR they fail to utilize.

Although brands say they will try not to pass these costs onto consumers, the situation is still doubtful. Uncertainties remain on the supply of high-quality food grade PCR material to meet California’s mandate as well as on the strategies beverage manufacturers are adopting based on the availability and price of recycled resins.

Substantial growth in recycled resin production would be needed to square the gap between supply and demand in the US, which is implausible to occur within such a short period of time. Under limited supply, large corporations are likely to dominate the market, challenging smaller manufacturers to comply with the mandate.

This is only the beginning.

Washington state and New Jersey have passed similar bills with recycled content mandates that start in 2023 and 2024, respectively, and include more product categories such as non-beverage containers, plastic carryout bags, and trash bags. These regulations, in conjunction with brands’ pledges, bring even more demand to a supply chain that is already challenged.