by Michael J. Devereux II, CPA, CMP

Mueller Prost

The holidays are here. For many, this means spending time with family and friends to recall good times throughout 2018 and to celebrate the upcoming new year. It also means that tax filing season is right around the corner. As such, December is a time for year-end tax planning to ensure Uncle Sam only assesses the appropriate amount of tax.

Tax planning can mean several things. Sometimes, plastics processors can recognize permanent tax savings by utilizing tax incentives, such as the R&D tax credit, the IC-DISC or the work opportunity tax credit. Other times, tax planning is all about accelerating tax deductions and deferring the recognition of revenue. For plastics processors, it’s typically a combination of both.

Moreover, tax planning is not done in a vacuum. Taxpayers must look at the current tax year, as well as future tax years, as some of the decisions a processor considers involve whether to accelerate or defer income from 2018 to 2019, or vice versa. So, when processors are reviewing tax-planning options, they should analyze two-year projections to ensure they understand what is being gained or missed.

Further, the Tax Cuts and Jobs Act (TCJA) will have a significant impact on plastics processors, many of which will see lower tax burdens in 2018 and beyond. The following is meant to provide plastics processors with some ideas and tips as they embark on year-end tax planning.

Lower rates

Tax rates were slashed across the board, with the corporate tax rate moving from graduated rates topping out at 35% to a flat 21% corporate tax rate. The corporate Alternative Minimum Tax (AMT) also was eliminated, thereby removing some of the impediments for processors using various tax credits.

Because of the reduction in the corporate tax rate, many processors organized as flow-through companies (S corporations, partnerships and LLCs) have already evaluated whether it makes sense to convert to a C corporation.

However, flow-through businesses also saw their tax rates drop through a combination of lower tax rates at the individual level and a new flow-through deduction equal to 20% of qualified business income for eligible taxpayers.

As a result, many flow-through companies determined that they are better off staying a flow-through entity. However, this analysis should be based upon each taxpayer’s facts and circumstances. While most will continue to operate as flow-through businesses, some will find that a C corporation structure may meet their needs.

It should be noted that not all companies will qualify for the new flow-through deduction. It begins to phase out for some service-based businesses once the owner’s income exceeds $315,000, but most plastics manufacturers will receive the benefit of the flow-through deduction.

Immediate expensing

The TCJA improved two popular deductions that allow for accelerated depreciation – §179 and bonus depreciation. The §179 deduction limit was increased to $1,000,000 and indexed for inflation. In addition, additional assets were added to the definition of §179 property, including HVAC and security systems. Further, more processors will qualify for §179, as the TCJA increased the phase-out threshold to begin at $2,500,000 of eligible assets placed in service.

The TJCA also increased the bonus depreciation percentage to 100%, retroactively, for property placed in service after September 27, 2017, through December 31, 2022. Beginning in 2023, the bonus depreciation percentage is phased down by 20% each year, with the accelerated “bonus” depreciation phased out by 2027.

These changes will, inevitably, make cost segregations more valuable. A cost segregation allows taxpayers to analyze the plant and equipment to segregate the cost of real property – which is generally depreciable over a 39-year life – from personal property – which is likely to have shorter depreciable life and qualify for one of the immediate expensing provisions. Taxpayers can “catch up” missed depreciation.

R&D tax credit

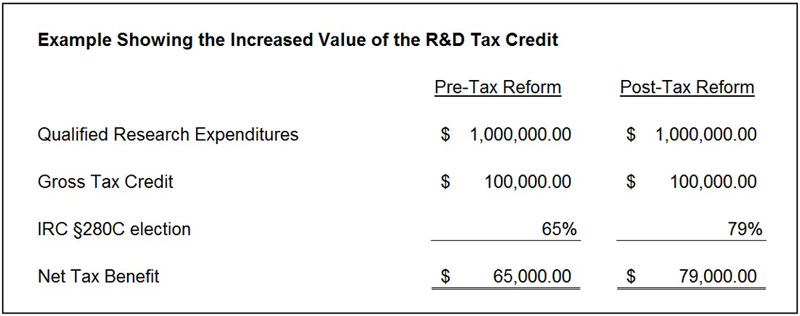

The R&D tax credit is the tax incentive likely to have the biggest impact in reducing a plastics processor’s tax liability (see Table 1). While IRC §41 (the code section governing the R&D tax credit) was not changed, the R&D tax credit’s value increased by 21.5% when the TCJA reduced the top corporate tax rate.

For processors making the proper §280C election on an originally filed return (including extensions), the value of the credit was increased significantly. The §280C election percentage is equal to 100% minus the top corporate tax rate. When tax reform lowered the top corporate tax rate from 35% to 21%, the applicable percentage found in §280C went from 65% to 79%. As a result, processors’ credits will be greater with the same level of research expenditures.

Methods of accounting

The TCJA expanded upon the accounting methods available to small and medium-size taxpayers. Plastics processors with average annual gross receipts of less than $25 million over the prior three years may adopt a number of accounting methods that were not previously available to them.

Those with less than $25 million of average gross receipts from the prior three years may change to the cash method of accounting, be exempt from the requirement to account for inventories, and exempt them from the UNICAP rules for tax years beginning after December 31, 2017. Each requires a separate accounting method change and some planning to ensure the change in method of accounting is done properly.

Conclusion

While the aforementioned ideas are likely to be the most impactful for plastics manufacturers, processors should evaluate what incentives, methods and structure is best for their situations, given their goals and fact patterns.

Michael Devereux II, CPA, CMP is a partner and director of manufacturing, distribution and plastics industry services at Mueller Prost CPAs + Business Advisors. To find out if you qualify for the R&D credit or any other available incentives, contact Devereux at mdevereux@muellerprost.com.