by Maria Nix, contributing writer, MAPP

Most manufacturing executives reading this article have survived an unprecedented year in business. While some have thrived, many are searching for sparks of hope to be used as fuel to drive forward and prosper in 2021. The good news is, according to over 220 executives who participated in the annual State of the Plastics Industry survey, there are many economic and business indicators to be optimistic about in the coming year.

The information contained in MAPP’s annual State of the US Plastics Industry Report (SOIR) has been used by many over the past two decades as a barometer to better understand the status, strength and momentum of the processing segment. This report examines fourth-quarter trends, first-quarter and 12-month sales outlooks (general forecasts), resin pricing trends, capital expenditure plans, challenges and operational changes. It allows company leaders to benchmark against all market sectors and provides crucial insights that can be used to help align companies for business success.

2020 in the rearview mirror

T he report begins with a look back at a year that brought many challenges. In terms of “sales levels today vs. one year ago,” 41% of the over 220 respondents stated their sales level increased, while 39% indicated their sales have decreased vs. this time last year. The sales decrease annotated by nearly four out of ten respondents represents the largest point drop ever recorded in year-over-year (YOY) decreases in MAPP’s SOIR history. Interestingly enough, there was no correlation between market segments served contributing to sales declines or increases; however, it was plain that larger companies – those above $50M in sales – outperformed all other-sized companies, with 64% of company executives representing this segment experiencing positive YOY sales growth.

he report begins with a look back at a year that brought many challenges. In terms of “sales levels today vs. one year ago,” 41% of the over 220 respondents stated their sales level increased, while 39% indicated their sales have decreased vs. this time last year. The sales decrease annotated by nearly four out of ten respondents represents the largest point drop ever recorded in year-over-year (YOY) decreases in MAPP’s SOIR history. Interestingly enough, there was no correlation between market segments served contributing to sales declines or increases; however, it was plain that larger companies – those above $50M in sales – outperformed all other-sized companies, with 64% of company executives representing this segment experiencing positive YOY sales growth.

When compared to Q3 of 2020, 56% of respondents saw an increase in sales in Q4 2020. Participants of the survey attributed this growth to implementation of new programs or increase of business with current customers. This is nearly 500 basis points (bps) above the 17-Year Historic Average of 52%, which is a positive tailwind and good momentum that will help to lift the industry in the first half of 2021.

Positive outlook for 2021

Nearly every economic indicator – including sales forecasts, staffing expectations, backlog trends and quoting activity – point to 2021 as a comeback year.

Nearly every economic indicator – including sales forecasts, staffing expectations, backlog trends and quoting activity – point to 2021 as a comeback year.

Sales Forecasts

In the next 12 months, 82% of respondents have forecasted sales to increase, while only 5% project a decrease. Customers are increasingly returning to work with pent-up demand and new programs, industry realignment is causing immense activity in the transfer tooling business, and business is moving back into the US at a higher rate than historically shown.

Production Levels

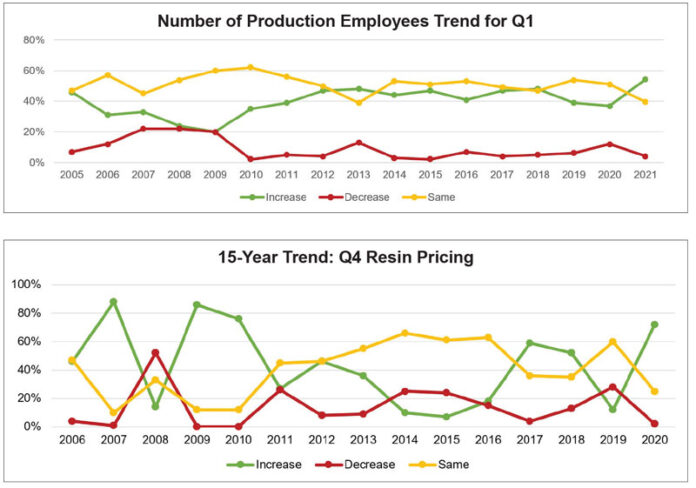

With that said, it is no surprise that labor demand and employment levels are following suit. The majority of executives are forecasting Q1 increases in both the production workweek and number of production employees. In fact, only 4% of respondents project a decrease in hour demand or number of employees, which is a positive indicator, especially when compared to last year’s 12% decrease.

Potential challenges in 2021

While the data suggests great business potential in 2021, the top challenges detailed by the respondents will inherently hinder the ability to fully take advantage of all the prospective opportunities.

Workplace Challenges

An ever-continuing challenge that directly impacts these employment level key performance indicators is the task of finding qualified workers. In looking at the top 10 challenges facing plastics companies in 2021, workforce remains number one, with 90% of companies listing it as one of their top three challenges that must be addressed this year.

This stat is down 1000 bps from the 2020 survey, which could be a sign that companies either have successfully improved their automation or – more probable – that priorities have shifted to other challenges, such as pandemic recovery or cost and availably of raw materials.

Raw Materials

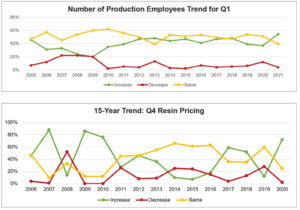

Cost and availability of raw materials ranked in the top three business challenges for 2021, which aligns with the data shown in the chart above for Q4 Pricing Trends. The chart shows 73% of survey respondents indicated that their price of resin increased in the fourth quarter of 2020, while only 2% saw decreases. Amount of increased price varied, but most identified paying from 2% to 12% more for raw materials than in previous quarters. Fortunately, 36% of companies were able to pass this increase in material costs directly to their customers.

Conclusion

Despite the challenges of the first year of the new decade, the bulk of industry executives are expecting a more robust business climate for 2021. The industry’s overall success in 2021 will teeter on several different issues, such as the speed of pandemic recovery, the ability to control costs, the ability to fill labor gaps and the mandate for each processor to focus on continuous improvement.

To obtain MAPP’s full State of the Industry Report: www.mappinc.com