By Andrew Carlsgaard, analytics director, MAPP

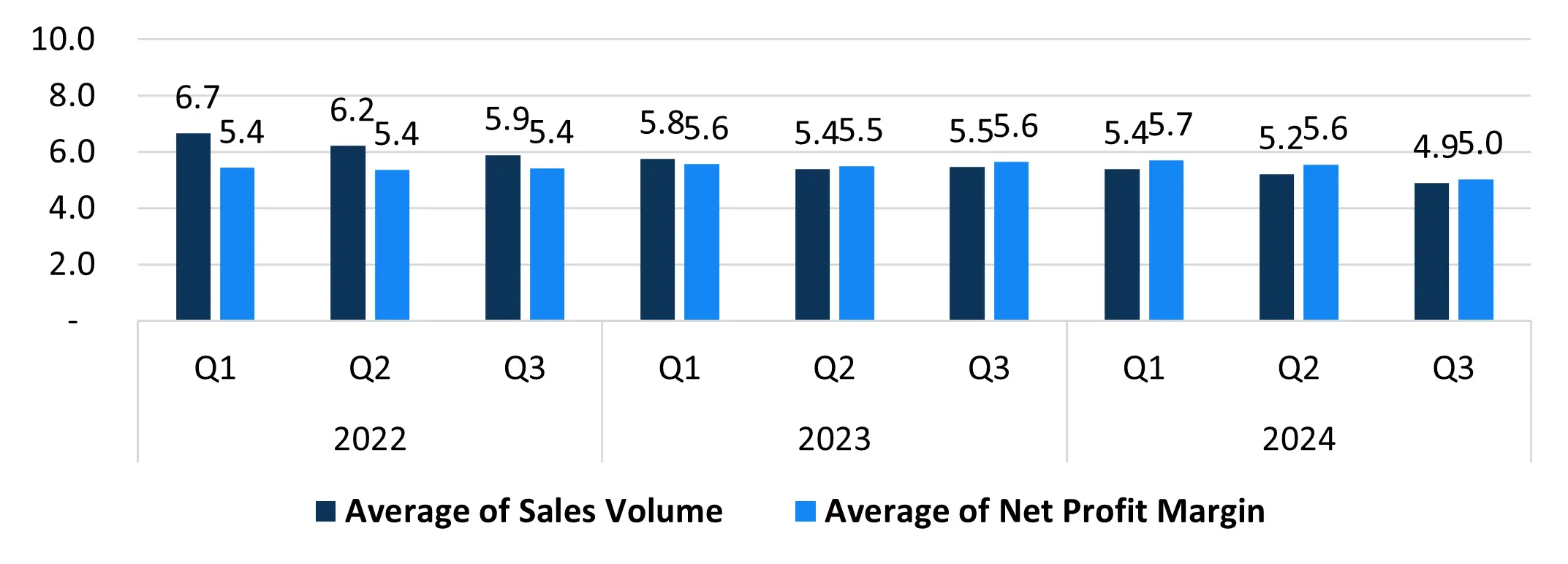

After what already has been an uneven year for processors to this point, MAPP’s Quarterly Pulse Report, based on feedback from 90 processing executives, reflects an increasingly skeptical US plastics industry at the end of the third quarter of 2024. This negative trend in processors’ sentiments has continued over the past four quarters, since the third quarter of 2023. This loss of confidence is not a trend unique to the plastics industry but to all US manufacturing. Aside from the on-time delivery rate, the Pulse Report’s sales and profitability sentiment metrics show negative trends compared to the previous year (third quarter 2023) and the prior quarter (second quarter 2024). Those five metrics (quoting volume, sales volume, backlog orders, shipping volume and net profit margin) are all rated 5.0 or less on a 10-point scale for the first time since this measurement began in 2022 (Chart 1). These downward trends of already middle-of-the-road sentiments (5.5/10 on average for all sales and profitability measures in the third quarter of 2024), combined with continually low capacity utilization, serve as cautionary indicators for future business outlooks. In the third quarter of 2024, processors reported capacity utilization of 53%. Comparing data from previous reports, it is a two-point decline compared to the first quarter of 2023 and a 10-point drop from two and a half years ago in the first quarter of 2022.

While some economic indicators show positive signs that the US is heading for a “soft landing” after the Covid-19 crisis (thus avoiding a major recession), the results of the 2024 Pulse Report and other industry indicators would give leaders reason for concern. Improved GDP growth, elevated consumer spending and relatively low year-over -year inflation (under 3%) recorded in the second quarter of 2024 paved the way for interest rate cuts by the Federal Reserve in September. However, high borrowing costs due to elevated interest rates have slowed the purchasing of cars and homes, making consumers wary of spending in these areas despite increasing expenditures in the retail sector. 1 Healthcare costs (indicated by higher premiums and deductibles) have continued to grow at an elevated yearly rate (7%) despite inflation slowing overall. 2 Along with a looming election, these factors continue to affect several vital segments of the US plastics industry, particularly the automotive, medical and industrial segments. The Pulse Report shows various metrics reflect these concerns, such as declining sales and financial sentiment, lower utilization and a stagnant six-month outlook.

S&P Global US Manufacturing PMI

This recent dip in the outlook for plastics processors also is seen across US manufacturing. One example of this is the S&P Global US Manufacturing PMI 3 (Chart 2) that S&P Global compiles from a panel of around 800 US manufacturers. According to S&P, the headline figure is the Purchasing Managers’ Index (PMI), which is a weighted average of the following five indices: new orders, output, employment (20%), suppliers’ delivery times (15%) and stocks of purchases (10%). The most recent analysis of the index by S&P noted that September marked the third consecutive month of decline (from 51.6 in June to 47.4 in September). The reasons given by management for this downward trend were that both output and new orders fell sharply due to weakened demand and political uncertainty. This mirrors much of the sentiment from plastics leaders in the Pulse Report. Overall, the report shows decreasing optimism for the perception of the processors’ business performances and the plastics industry over the next six months. For the third quarter of 2024, both measures took a notable dip below the previous quarter and year, averaging roughly 5.2 points out of 10 (with five being neutral).

Going into the last quarter of 2024, the US plastics industry will continue to face hurdles during heightened political, regulatory and economic uncertainty, and will almost certainly feel the aftereffects of the election – whether positive or negative. Regardless of which party succeeds, the most successful leaders will continue to leverage their available resources to adapt their business models by ensuring ongoing profitability while looking for opportunities for future expansion. This may involve increased investment in automation, broadening customer bases or reassessing workforce expenses and overhead. Any such adjustments demand thorough self-assessment to identify optimal strategies. While optimism among industry leaders is in short supply for the time being, processors need to position themselves with every opportunity to take advantage of steady economic growth at the beginning of 2025, depending on how elections, wars and other macroeconomic forces clarify the manufacturing situation over the next year.

The Quarterly Pulse Report aims to capture quarterly data points that will lead to insights that help executives better understand the current and projected near-term state of the plastics processing industry to make better, more informed decisions. The Manufacturers Association for Plastics Processors (MAPP) collected data from September 16 through October 15, 2024. The statistics in this report represent the views of 90 plastics manufacturing leaders primarily serving over 20 different industry segments.

References

- WSJ: U.S. Consumers Drive Retail Sales Growth, https://www.wsj.com/economy/retail-sales-september-us-consumers-economy-af405a46?st=aLC6gD&reflink=desktopwebshare_permalink

- WSJ: Healthcare Premiums Are Soaring Even as Inflation Eases, https://www.wsj.com/health/healthcare/health-insurance-inflation-charts-612812ed?mod=consumers_news_article_pos5

- S&P Global United States Manufacturing PMI, https://tradingeconomics.com/united-states/manufacturing-pmi